The One-Page VCP: Why Simple Beats Smart in Value Creation Planning

I’ve noticed a funny pattern in the PE world: the more important something is, the more likely we are to big-brain it into oblivion. I’ve done it too.

Take, for example, the revered value creation plan every PE-backed company is supposed to have. Important? You betcha. So we'd better add 14 initiatives, 34 subtasks for each, 7 matrices complete with Harvey balls, and a Gantt chart that requires binoculars. And that’s all great… unless we want people to actually execute any of it.

Here's the trouble: complexity feels smart, but it's execution's worst enemy.

THE ONLY QUESTION THAT MATTERS

If your chosen vocation is to be a private equity leader, your success ultimately comes down to one deceptively simple question:

Can you turn one dollar of investor money into three dollars (or more)?

That's the job. That's the scoreboard. It's not the only thing that matters as a human being, and it isn’t meant to marginalize the other stakeholders you must serve—your customers, your employees, your partners, your community.

But like it or not, in PE, when the music stops, the question isn't "Were you a nice leader?" It's: "Did you create equity value?" And if you didn't, your career in this space will be short-lived.

SO CAN YOU ACTUALLY EXPLAIN HOW YOU’LL DO IT?

Let’s take that question a step further:

Can you actually say how you’ll turn one dollar of investor money into three dollars (or more)?

"Value creation," the fancy term for turning $1 into $3+, has become PE's buzzword of the decade. Plenty of CEOs assume their teams are aligned on the value creation plan. But when you ask to see that plan, the room goes still. Why? Because the alignment isn't there. Trust me: I've seen this umpteen times.

Some CEOs point upward, as if the plan is floating in the ceiling tiles. (“It’s in my head.”) Others dig out a 60-slide strategy deck last updated back when fidget spinners were cool. Both are equally useless. And both have the same outcome: no one actually knows how the company is supposed to turn that $1 into $3+.

The uncomfortable truth is: if you can't point to a simple, clear plan for how you'll turn one dollar into three, you don't actually have a plan.

THE HEART OF THE PROBLEM

A big part of the problem is that in private equity, we love to big-brain things. We make stuff fancy and complicated—the multi-tab models, the thick strategy decks, the endless frameworks. They look impressive. They feel impressive.

But here's the rub: when your team can't quickly get its arms around what it needs to focus on to maximize value creation, it does nothing or focuses on the wrong things.

This is why the one-page plan—humble, minimalist, suspiciously simple—matters far more than the fancy things we build to feel smart.

THE POWER OF THE ONE-PAGE PLAN

I've long been a big believer in the power of a one-page value creation plan.

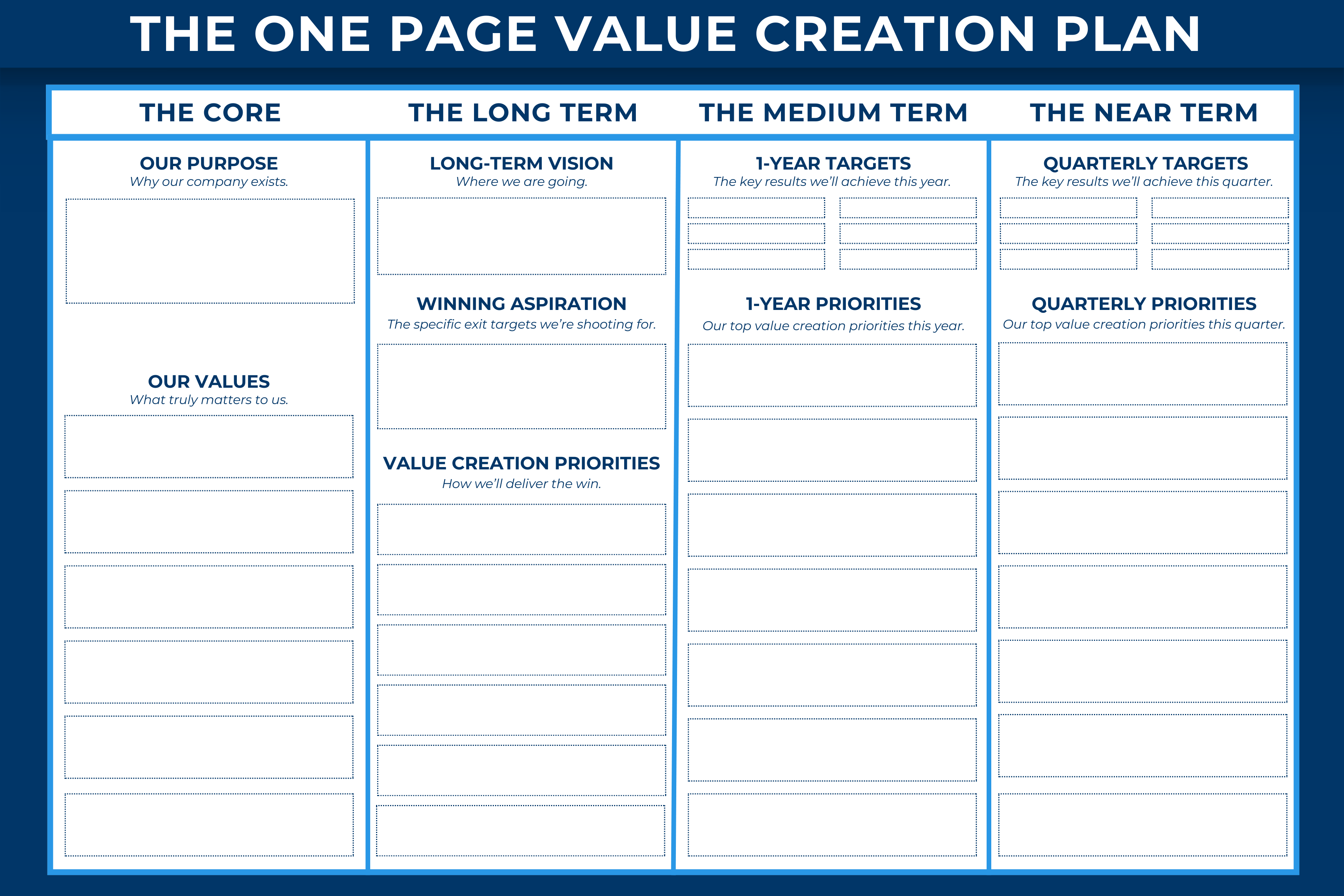

In my PE days, we stumbled upon the one-page plan concept in Rockefeller Habits. We tweaked its format to better fit private equity, and made it mandatory across our portfolio. We weren't especially heavy-handed as investors, but developing a one-page plan was a non-negotiable requirement we had for our portfolio companies: You must be able to say on a single sheet of paper how you're going to build an enduring, valuable business.

It did exactly what you'd expect: forced clarity, drove focus, and got everyone—board, leadership team, investors—onto the same page (quite literally). Simple, but a game changer.

Yes, I can hear the PE associates clutching their laptops: “One page?! Impossible. Our business is too complicated.” And you’re right: one page isn’t sufficient. But it is necessary.

What makes a one-pager so useful is that it forces you to choose. When you only have 8.5” x 11” of real estate to work with, you can't include everything. You have to prioritize. You have to get really crisp on: "These are the 4–5 most value-generative moves that will actually turn $1 into $3 over the next X years."

Sure, you’ll need the tactical details behind each of those big value creation opportunities. The detail matters. Just don’t confuse detail with clarity. Without a distilled-down top-layer view, the team can lose the forest through the trees. Without the forest view–the one-page plan—the trees blur together.

But when you boil it down to one page, something powerful happens. Suddenly, everyone can look at a single sheet and say, “Yep, that’s how we’re going to win.” Focus sharpens. Energy and resources flow to the right places. People start pulling in the same direction.

Simplicity isn’t about dumbing things down. It’s about creating clarity. And clarity drives execution. Execution drives equity value. That’s the order.

YOUR TURN

This brings us to a small but telling question, a gut-check I quietly ask leaders I work with:

If I asked you right now to show me your value-creation plan… could you?

Like, could you literally swivel in your chair and pick it up? Or pull it up in a shared folder without 23 mouse clicks? If not, that’s your answer. It’s time to write it down, and boil it down… to one page.

And here’s the interesting thing: the moment leaders actually sit down to write it out, some discover something they didn’t expect: they’re not actually as clear as they thought they were.

I see this all the time in the value creation planning work I do with PE leadership teams. Leaders walk into the room feeling confident. “We’re good. We know our plan.” And then, as I start prompting them for the value creation elevator pitch, the fog rolls in.

Sometimes their thinking is too abstract. “We’re focusing on organic revenue growth.” Sometimes they’re buried in the weeds of the business. They’re in the trees, and the forest has gone missing. Either way, being forced to write it down has a way of revealing that… and fixing it.

This is the quiet magic of a one-page plan. It’s not really about the page. It’s about what the page makes you do. It brings the fuzziness into focus. It turns hand-waving (“We’ll accelerate organic revenue growth”) into more precise strategic choices. It gives your team something they can look at and say, “Oh, now I get it.” And in a world where execution is the whole game, that tiny sheet of paper becomes the difference.

A client of mine — founder and Managing Partner of an East Coast PE firm — once laughed and said, “I’m not sure what we did before we made our port-co’s draft a one-page plan.” The issue wasn’t that they lacked ideas for driving value creation, but that they lacked clarity and alignment. The plan-on-a-page rectified that.

One page. Big leverage.